I’ve been working on a new presentation…as some of you know, I get invited to speak occasionally about My Lessons Learned. It’s always lots of fun with great questions. I started thinking about the thing I am most passionate about and have been practicing the last 25 years…and that’s what I’m calling Personal Profitability.

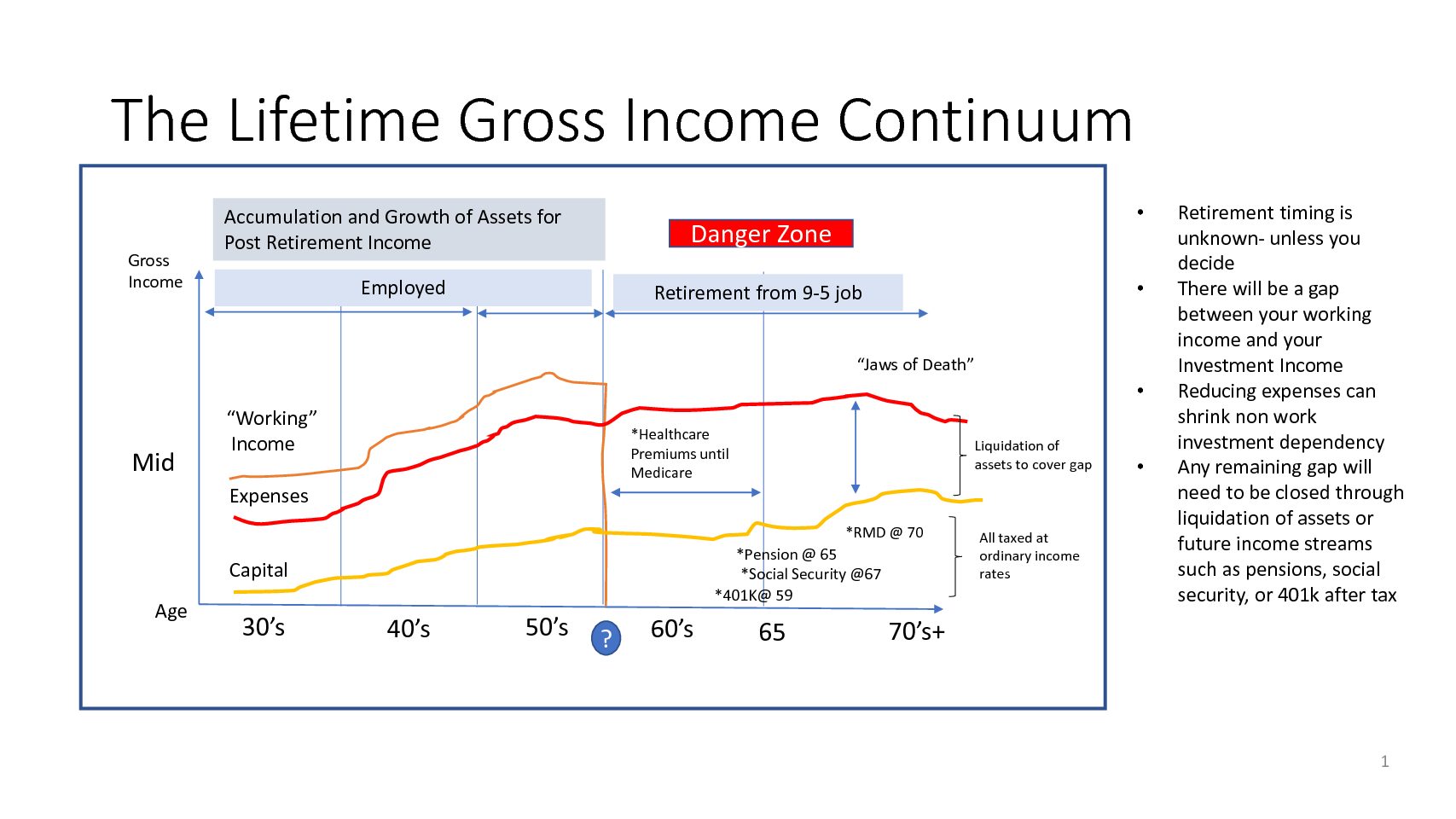

The picture is one of the slides in my presentation. I call it The Lifetime Gross Income Continuum. Dramatic, huh?

So the point of the graph is pretty simple: while you’re working, in most cases it’s manageable to keep up with your expenses. Sure, you might have setbacks like losing a job, or a divorce, but for the most part, you can adapt.

The challenge happens when you retire…no longer generating work income. Besides not earning whatever you were earning (which is most likely the peak of your career), retirement is often not planned. A wise managing director once said to me “Grace, you will retire. It’s just a question of whether or not you’re deciding when, or the firm is.”

So if it happens earlier than expected, you’ll need to switch to plan b. Optimally, you’ve been able to invest with income generating investments. Maybe you’ve reduced expenses enough that you’re covered. But in any case, you’ll need to be prepared:

- Retirement timing is unknown- unless you decide

- There will be a gap between your working income and your Investment Income

- Reducing expenses can shrink non work investment dependency

- Any remaining gap will need to be closed through liquidation of assets and/or future income streams such as pensions, social security, or 401k after tax

Let me be clear, I don’t make any recommendations on asset allocation: to me that’s a deeply personal choice because it depends on what you’re comfortable with. I know people who make millions of dollars a year who can’t sleep at night without a million dollars in their checking account. I know people at the age of 77 who still trade options. So it really depends on you.

But regardless, it’s necessary to have a plan. To do the math and have contingencies….upon contingencies. Time is on your side…until it’s not.